Gold Price Predictions Point to $1,300 Before the End of August

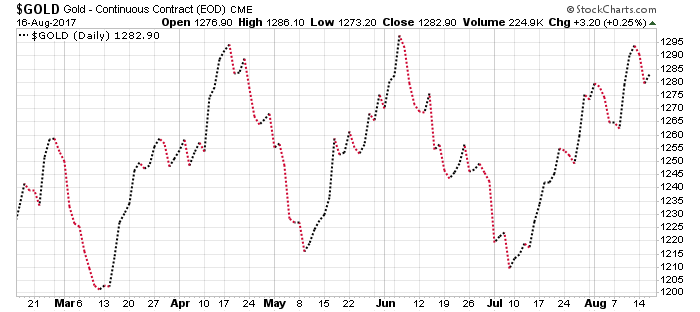

Gold price predictions for August should remain bullish. Last Friday, the price of gold reached $1,289 per ounce. It continues to sustain the $1,280 per ounce level. Could this signal the rise of a sustained bullish trend? The third time’s a charm, as the old saying goes. And the latest move represents the third time in 2017 that the price of gold tries to break the $1,300-per-ounce resistance level in 2017.

Gold got close to breaking the $1,300-per-ounce mark last April. At that time, a sudden reversal in Trump’s policy regarding Syria (and Russia) raised concerns and pushed gold up. But the stock market maintained momentum and reversed gold’s path. Now, there’s the sensation that too many stocks on Wall Street are overvalued. This has given the gold price forecast for August a bullish wind.

Also Read: The Gold Price Forecast 2018 Might Surprise You

The August gold price trends have been favorable. They would have been even more favorable had Bitcoin not stolen the limelight. The blockchain technology-based cryptocurrency has reached well over $4,000, more than doubling since July. The Bitcoin craze appears to be just that.

It’s a fever pitch bubble, comparable to the tulip bulb bubble of the early 1600s. Add a potential banking crisis and a major market correction in the final quarter of 2017 to that volatile mix and you understand why gold shines. The moment gold price futures beat $1,300 per ounce, there’s no telling how far the yellow metal could hit.

The gold monthly chart in 2017 has shown that $1,300 is a key price. It will take an important risk factor to the markets for the gold price forecast for 2017 to sustain a bullish stance. It so happens that a series of factors are cooperating to make that happen now.

Chart courtesy of StockCharts.com

The gold price recovery began as a technical rebound after having hit its lowest price—$1,213 per ounce—in early July. But the momentum of gold prices as a result of a sharp drop of the dollar against major currencies like the euro has gained strength. The increasing geopolitical tensions between the U.S. and North Korea, internal tensions in the United States itself, and a general climate of uncertainty cannot but intensify the favorable gold price trend.

That said, if gold does not manage to hit $1,300 per ounce within the next few weeks, it might reverse the bullish gains achieved so far. Should the U.S. Federal Reserve decide to cool off the markets by applying another interest rate hike, it would not benefit gold. But, the Fed members are not singing the same tune when it comes to interest rates. An important conflict is brewing that could postpone the next interest rate increase to 2018.

Credits: Pixabay.com/Stevebidmead

Inflation remains low, which suggests that the U.S. economy is not growing quickly enough to justify a hike. That would only slow the economy down further, potentially crippling it. Profit taking notwithstanding, the conditions for the price of gold to increase exist now. (Source: “Fed minutes: Central bank split over path of rate hikes,” CNBC, August 16, 2017.)

The price of gold will be influenced by U.S. economic information. European indicators, as well as those from China, could be mixed at best. Some EU members have experienced a slight resumption of growth, but not enough to prompt investors to ignore gold. Indeed, the ever tenser political climate in the United States should produce a bullish impact on the price of gold.

Potential U.S. North Korea War Leaves Investors with Few Alternatives to Gold

Volatility is up and the VIX index has reached the highest level since November 2016—when the presidential election took place. This indicates that the level of fear and uncertainty among investors is very high. This is of great concern to institutional investors such as mutual fund managers, pension funds, hedge funds, and large holding companies.

North Korea has diffused tensions now, but the dispute between itself and the U.S. has not been resolved by any means. Washington is under pressure to take action and a preemptive attack cannot be ruled out. The divisions manifested through Charlottesville, Virginia make it even more likely that President Trump might seek to restore unity by putting pressure on an external enemy. North Korea makes for a strong trigger for gold resuming its role as a safety asset.

The fears of a potential U.S./North Korea war will likely detract investors from their profit taking instinct. As the dollar remains under pressure because of renewed uncertainties over the course of the economy at the Fed, the price of gold should continue to climb. The volatility index (VIX) offers a valuable hint of gold’s potential.

The war of words between Donald Trump and Kim Jong-un has taken a temporary break. Meanwhile, stocks on Wall Street are trading at very high prices. A market correction might be already overdue. Thus, when it comes, it will hit with a vengeance. Gold is waiting patiently for its chance to shine.